Mortgage Calculator

|

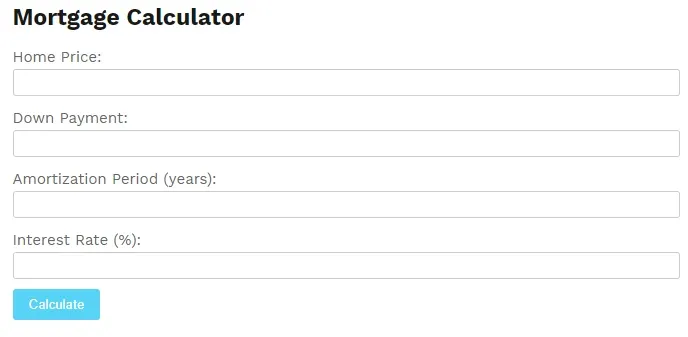

| Photo: Mortgage Calculator TD: web tool to calculate mortgage |

Mortgage Calculator - How to Calculate Your Monthly Mortgage Payment

Use this mortgage calculator to determine your monthly mortgage payment. Enter your home price, down payment, amortization period, and interest rate to calculate your mortgage payment.

A mortgage calculator is a useful tool that can help you determine your monthly mortgage payment. By entering your home price, down payment, amortization period, and interest rate, you can calculate your monthly mortgage payment and make an informed decision about your home purchase.

In this article, we will show you how to use a mortgage calculator to calculate your monthly mortgage payment. We will also explain the different factors that affect your mortgage payment and provide tips for choosing the right mortgage for your needs.

How to Use a Mortgage Calculator TD:

To use a mortgage calculator, follow these simple steps:

1. Enter your home price: This is the total cost of the home you wish to purchase.

2. Enter your down payment: This is the amount of money you will pay upfront for the home.

3. Enter your amortization period: This is the length of time you will take to pay off your mortgage, typically 15 or 30 years.

4. Enter your interest rate: This is the percentage rate at which you will be charged for borrowing the money.

5. Click on the "Calculate" button: The mortgage calculator will then calculate your monthly mortgage payment based on the information you entered.

Factors That Affect Your Mortgage Payment:

Several factors can affect your monthly mortgage payment. These include:

1. Home price: The higher the home price, the higher your monthly mortgage payment will be.

2. Down payment: The larger your down payment, the lower your monthly mortgage payment will be.

3. Amortization period: The longer your amortization period, the lower your monthly mortgage payment will be, but the more interest you will pay over the life of the mortgage.

4. Interest rate: The higher your interest rate, the higher your monthly mortgage payment will be.

Tips for Choosing the Right Mortgage TD:

When choosing a mortgage, consider the following tips:

1. Shop around: Compare different mortgage rates and terms to find the best deal.

2. Consider your budget: Choose a mortgage that fits within your budget and allows you to comfortably make your monthly payments.

3. Understand the terms: Make sure you understand the terms of the mortgage, including any fees, penalties, or prepayment options.

Conclusion:

A mortgage calculator is a valuable tool that can help you determine your monthly mortgage payment and make an informed decision about your home purchase.

By entering your home price, down payment, amortization period, and interest rate, you can calculate your monthly mortgage payment and understand the different factors that affect it. Use these tips to choose the right mortgage for your needs and budget.

Other calculators:

i likes the calculator

ReplyDeletePost a Comment